A local displays a fifty-Zimbabwean dollar note in Harare, capital of Zimbabwe, July 24, 2021. (Photo by Shaun Jusa/Xinhua)

The Zimbabwe dollar (ZWL), the local currency of Zimbabwe, has kept losing ground against the U.S. dollar.

HARARE, April 22 (Xinhua) -- The Zimbabwe dollar (ZWL), the local currency of Zimbabwe, has kept losing ground against the U.S. dollar.

After hovering just below 1,000 to the U.S. dollar on the Reserve Bank of Zimbabwe (RBZ) foreign auction platform for several weeks, the Zimbabwe dollar finally succumbed to pressure and fell to 1,000.0227 Tuesday.

This means that a person with 1,000 U.S. dollars can easily translate it to 1 million ZWL, or even more on the parallel market which was on Friday trading at 1 U.S. dollar to 1,600 ZWL for those who were selling the U.S. dollar. Those who were buying had to part with at least 1,800 ZWL per U.S. dollar.

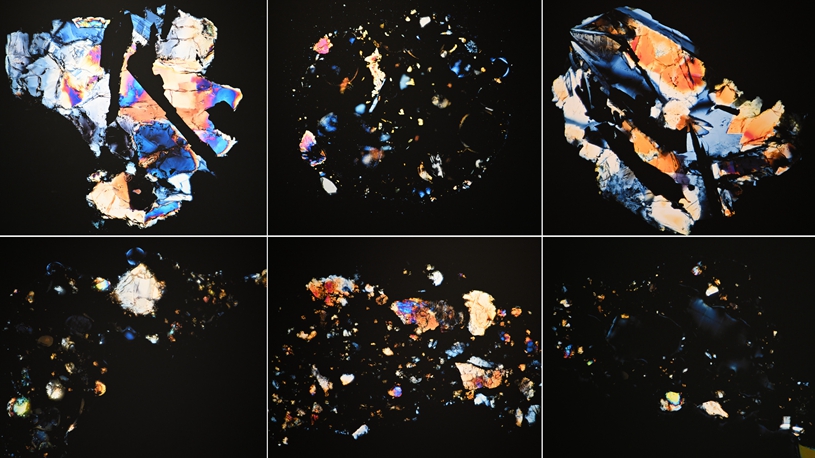

People exchange U.S. dollar notes on a street in Harare, Zimbabwe, Feb. 23, 2023. (Photo by Tafara Mugwara/Xinhua)

The new millionaire club does not have much to show for it though, with the depreciation of the local currency also leading to increases in the prices of basic commodities, as traders chase the parallel market rate.

While some retailers have been modest with the increases, pharmacies, hardware shops and informal traders have been unrelenting.

An analysis of the country's operating environment posted by Stanbic Bank Friday showed that Zimbabwe's food inflation remained the highest in the world in April.

"Notwithstanding the decline in world food prices and according to the World Bank, Zimbabwe's food inflation remains the highest in the world. High food inflation is mainly attributed to the rapid currency depreciation (high parallel market premium) and some supply bottlenecks," the analysis said, claiming that Zimbabwe remained uncompetitive from a price stability viewpoint.

"Inflation is high in the outlook driven by rapid exchange rate depreciation, high monetary growth and risk of potential fiscal slippages," the analysis said.

Independent economist Paul Musodza warned that the continued dollarization of the economy was not good for the country in the long term.

He said the official exchange rate was being directed by the parallel market which had crossed the 1,000 mark way back.

"It is the real exchange rate. We are highly dollarized because output is now largely U.S. dollar priced. Dollarization will retard our economic growth rate," he said in an interview with Xinhua.

A local displays a fifty-Zimbabwean dollar note in Harare, capital of Zimbabwe, July 24, 2021. (Photo by Shaun Jusa/Xinhua)

The Monetary Policy Committee of the RBZ, the central bank, said at the end of March that there was a 70:30 currency mix of foreign and local currency, respectively, in the economy.

The government and the central bank have over the years been trying to make the local currency more attractive to the transacting public by introducing a raft of measures.

However, the specter of 2008 when the official inflation rate hit 231 million percent, the national budget's figures were given in quintillions of dollars and the highest banknote denomination was 100 trillion Zimbabwe dollars continues to haunt many people.

At present, the highest banknote denomination is 100 Zimbabwe dollars -- which is equivalent to about 10 U.S. cents at the prevailing official exchange rate. The smaller denominations of 2, 5 and 10 ZWL notes are no longer used by the public, even though they are officially still in circulation together with 20 and 50 ZWL denominations. ■