The U.S. Capitol building is seen in Washington, D.C., the United States, Nov. 8, 2022. (Xinhua/Liu Jie)

Such a forcible-feeble delusion won't make the United States better equipped to maintain its global technological supremacy, only to pull it further away from the global trading system of its own dynamics.

by Xinhua writer Ma Qian

BEIJING, Aug. 14 (Xinhua) -- In the wake of disillusionment with their "de-coupling" scheme, Washington's elites have come under a delusion that by building "a small yard, high fence" and "de-risking" relationships with strong competitors, America's supremacy could be guaranteed.

They are actually, if not knowingly, making a mockery of themselves.

Investment curbs, export controls, financial sanctions ... Now China is in the crosshairs of these hackneyed U.S. approaches. Ostensibly punitive, they are indeed cost-ineffective and counterproductive, exposing Washington's forcible-feeble policy-making, which would lead to dampened innovation, rockier trade, and spiraling instability.

The United States is backtracking on free trade by choking U.S. enterprises' freedom of investing, when President Joe Biden signed an executive order last week to block U.S. investments in such advanced technologies in China as semiconductors and microelectronics, quantum information technologies, and artificial intelligence (AI).

The new constraints were slapped following three top U.S. officials' Beijing visits, as part of Washington's publicly-voiced efforts to pursue a detente with China, and a repeated claim that it is not severing trade with China.

Little wonder the U.S. flip-flop on China goes in line with the Biden administration's established China containment strategy, which boils down to three words -- invest, align, compete.

However, by blowing hot and cold, Washington only exposed its duplicity and rapacity in international relations, and its policy-setting toward China is shown as fragmented, incoherent and unprincipled.

Washington's decision-makers do not treat the China-U.S. relationship as a whole, but break it into different parts to seek strategic advantages and self-serving interests. Those politicians preferred a more narrow "de-risking" of ties with a "small yard, high fence." It, however, turns out to be exploiting the concept of national security to stymie China's efforts to develop its own microelectronic and supercomputing capabilities.

The U.S. attempts to weaponize its market dominance in the high-tech sector to contain China's technology ambitions, as the Foreign Affairs magazine has pointed out, are an "illusion of controls," and America will not succeed in slowing China's indigenous technology advances.

This aerial photo taken on July 11, 2023 shows new energy vehicles for export at a terminal of Taicang Port, east China's Jiangsu Province. (Photo by Ji Haixin/Xinhua)

For U.S. companies, the new executive order would be costly, since Washington deliberately ignores the ensuing costs they have to incur. For U.S. entrepreneurs, the "small yard, high fence" appear to be highly insecure and even suffocating, as they are forced to shoulder extra political burdens, only to pay for Washington's defective foreign policy and potential electoral gains.

Since making investments requires forward-looking judgments, U.S. investors tend to adapt to the changing cross-border business conditions by being more prudent with investments in the designated "sensitive" sectors in China. That will inevitably put them on the back foot.

As the 2024 presidential election has started to approach, politicians on both sides of the aisle would get tougher on China by exploiting measures to suppress the country to their advantage. In this case, Washington would pass over the aftershock of such measures.

The U.S. business community has pushed back against what it considers to be "the politicization of private markets," Claire Chu, a senior China analyst at Janes, a defense intelligence company, told The New York Times.

During a recent White House meeting, U.S. semiconductor giants weighed in with opposition. The chief executive officers of Intel, Nvidia and Qualcomm criticized Washington's relentless approach, saying the restrictions would surely backfire, stripping them of a big revenue source.

The Semiconductor Industry Association said China is the world's largest single semiconductor market, accounting for 180 billion U.S. dollars in chip purchases last year, or more than a third of the world's total.

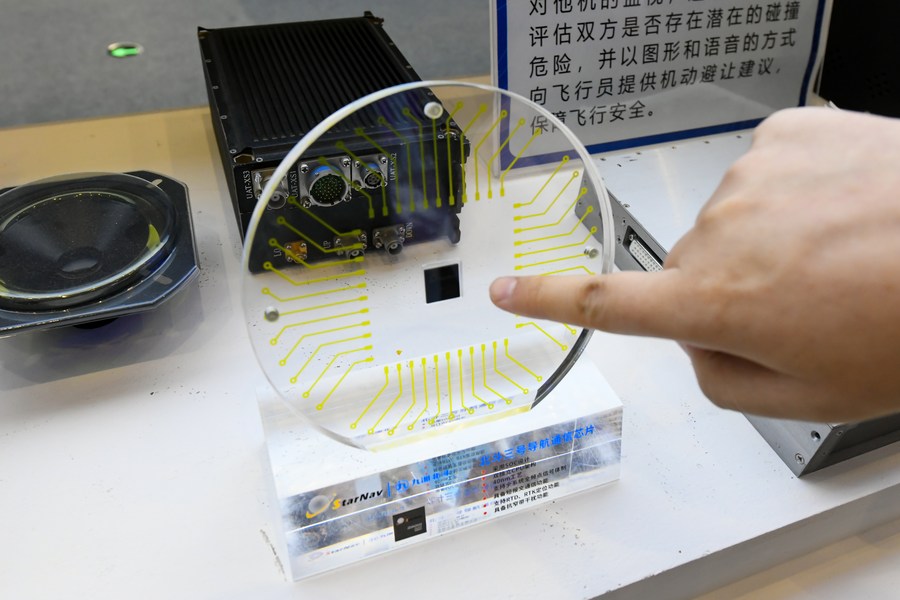

A communication chip of China's BeiDou-3 Navigation Satellite System is on display at the 10th China (Mianyang) Science and Technology City International High-Tech Expo in Mianyang, southwest China's Sichuan Province, Nov. 16, 2022. (Xinhua/Tang Wenhao)

More importantly, such U.S. "national security" restrictions have had little effect on blocking China's technological progress nor boosting their own. From a practical perspective, they are counterproductive.

Despite Washington's attempt to de-risk economic relationship with China, trade links between America and China, instead of being slashed, are enduring -- "just in more tangled forms," The Economist has pointed out.

The problem, the British weekly said, is that trade between U.S. allies and China is rising, "suggesting that they are often acting as packaging hubs for what, in effect, remain Chinese goods."

Apart from posing more harm than good to U.S. enterprises, U.S. "de-risking" moves, in turn, have made China more self-reliant and capable to resist external suppression.

China's breakout success in emerging strategic sectors like 5G and AI, strong high-tech manufacturing, as well as extensive telecom infrastructure and related applications have all made it stand out in the global high-tech arena with sustainable competitive edges.

Washington won't succeed in choking off capital to Chinese high-tech startups, as a more isolated China also may struggle to replicate the sheer size of the U.S. funding ecosystem, the Wall Street Journal said in a recent report.

In this regard, Victor Shih, a political science professor at the University of California San Diego, told Xinhua that the segmentation of the global market will create very capable Chinese chip competitors, since Chinese buyers now have no choice but to buy from domestic chips makers, giving them a large captive market.

Cutting others off won't bolster one's own growth, while healthy competition may well make it. Washington's "de-risking" move, seemingly vigorous, is in effect frail and insipid.

Such a forcible-feeble delusion won't make the United States better equipped to maintain its global technological supremacy, only to pull it further away from the global trading system of its own dynamics. ■