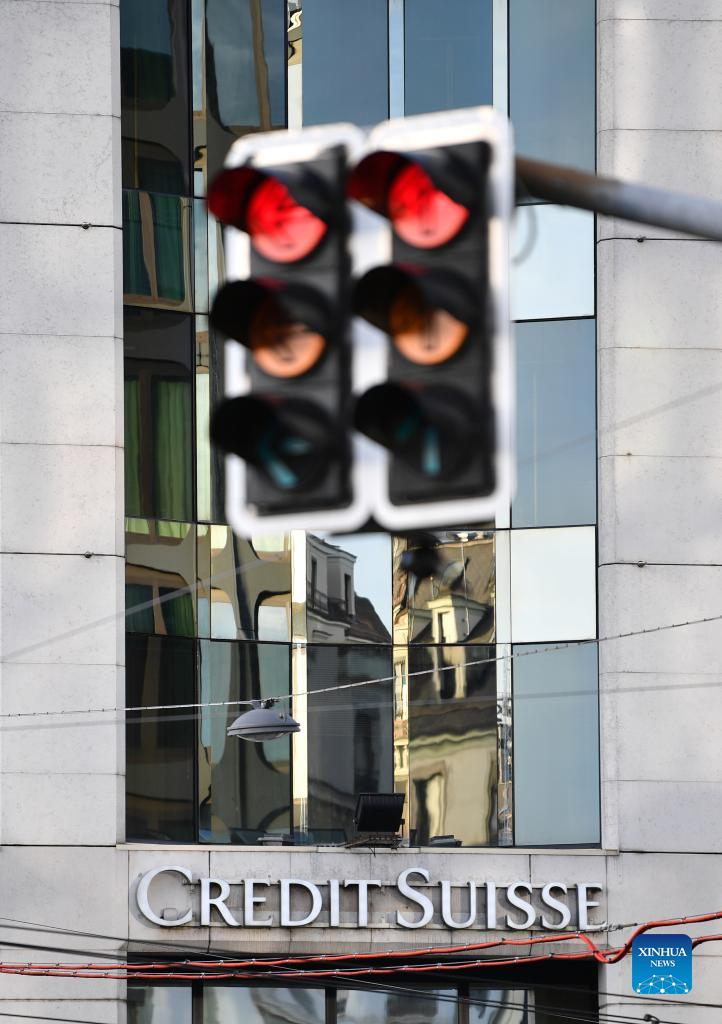

Photo taken on March 16, 2023 shows a building of Credit Suisse in Geneva, Switzerland. As the shares of Credit Suisse fell to a record low on Wednesday, the second largest bank in Switzerland said it would borrow up to 50 billion Swiss francs (53.89 billion U.S. dollars) from the Swiss National Bank (SNB). (Xinhua/Lian Yi)

GENEVA, March 16 (Xinhua) -- As the shares of Credit Suisse fell to a record low on Wednesday, the second largest bank in Switzerland said it would borrow up to 50 billion Swiss francs (53.89 billion U.S. dollars) from the Swiss National Bank (SNB).

Credit Suisse is taking decisive action to preemptively strengthen its liquidity by borrowing from the SNB under the latter's Covered Loan Facility and a short-term liquidity facility, which are fully collateralized by high quality assets, according to a statement issued by Credit Suisse on Thursday.

"These measures demonstrate decisive action to strengthen Credit Suisse as we continue our strategic transformation to deliver value to our clients and other stakeholders. We thank the SNB and FINMA (Swiss Financial Market Supervisory Authority) as we execute our strategic transformation," said Ulrich Koerner, chief executive officer of Credit Suisse.

The loan announcement came as Credit Suisse shares rose over 30 percent when the market opened on Thursday.

Credit Suisse also announced offers by Credit Suisse International to repurchase certain OpCo senior debt securities for cash of up to approximately 3 billion Swiss francs.

This additional liquidity would support Credit Suisse's core businesses and clients as the bank takes the necessary steps to create a simpler and more focused bank built around client needs, the statement said.

Since Tuesday, Credit Suisse's shares have fallen continuously, slumping by more than 20 percent on Wednesday.

The bank's shares opened at 2.28 Swiss francs per share on Wednesday morning, before falling to 1.55, and closing at an all-time low of 1.70.

Founded in 1856, Credit Suisse has an important influence on the global capital market.

Since 2021, the bank has been plagued by negative news, such as investment losses. The stock price of Credit Suisse has continued to fall, and its market value has significantly declined.

In early February, Credit Suisse posted a net loss of 7.3 billion Swiss francs for 2022, while in 2021 its net loss was 1.7 billion Swiss francs.

According to the bank's 2022 annual report released on Tuesday, there was "material weakness" in internal controls over financial reporting.

Meanwhile, the Saudi National Bank, a major shareholder of Credit Suisse, said on Wednesday that it would not increase its stake in the bank.

These two events have further battered Credit Suisse's stock prices, and the collapse of Silicon Valley Bank in the United States has seen the stock prices of European banks generally plummeting.

Late on Wednesday, the SNB and FINMA issued a statement on market uncertainty. The SNB said it would provide the troubled investment bank with liquidity if required. (1 Swiss franc=1.08 USD) ■

Photo taken on March 16, 2023 shows a building of Credit Suisse in Geneva, Switzerland. As the shares of Credit Suisse fell to a record low on Wednesday, the second largest bank in Switzerland said it would borrow up to 50 billion Swiss francs (53.89 billion U.S. dollars) from the Swiss National Bank (SNB). (Xinhua/Lian Yi)

Photo taken on March 16, 2023 shows a signage of Credit Suisse in Geneva, Switzerland. As the shares of Credit Suisse fell to a record low on Wednesday, the second largest bank in Switzerland said it would borrow up to 50 billion Swiss francs (53.89 billion U.S. dollars) from the Swiss National Bank (SNB). (Xinhua/Lian Yi)

A man walks past Credit Suisse in Geneva, Switzerland, on March 16, 2023. As the shares of Credit Suisse fell to a record low on Wednesday, the second largest bank in Switzerland said it would borrow up to 50 billion Swiss francs (53.89 billion U.S. dollars) from the Swiss National Bank (SNB). (Xinhua/Lian Yi)

A woman is seen inside Credit Suisse in Geneva, Switzerland, on March 16, 2023. As the shares of Credit Suisse fell to a record low on Wednesday, the second largest bank in Switzerland said it would borrow up to 50 billion Swiss francs (53.89 billion U.S. dollars) from the Swiss National Bank (SNB). (Xinhua/Lian Yi)

Photo taken on March 16, 2023 shows a building of Credit Suisse in Geneva, Switzerland. As the shares of Credit Suisse fell to a record low on Wednesday, the second largest bank in Switzerland said it would borrow up to 50 billion Swiss francs (53.89 billion U.S. dollars) from the Swiss National Bank (SNB). (Xinhua/Lian Yi)