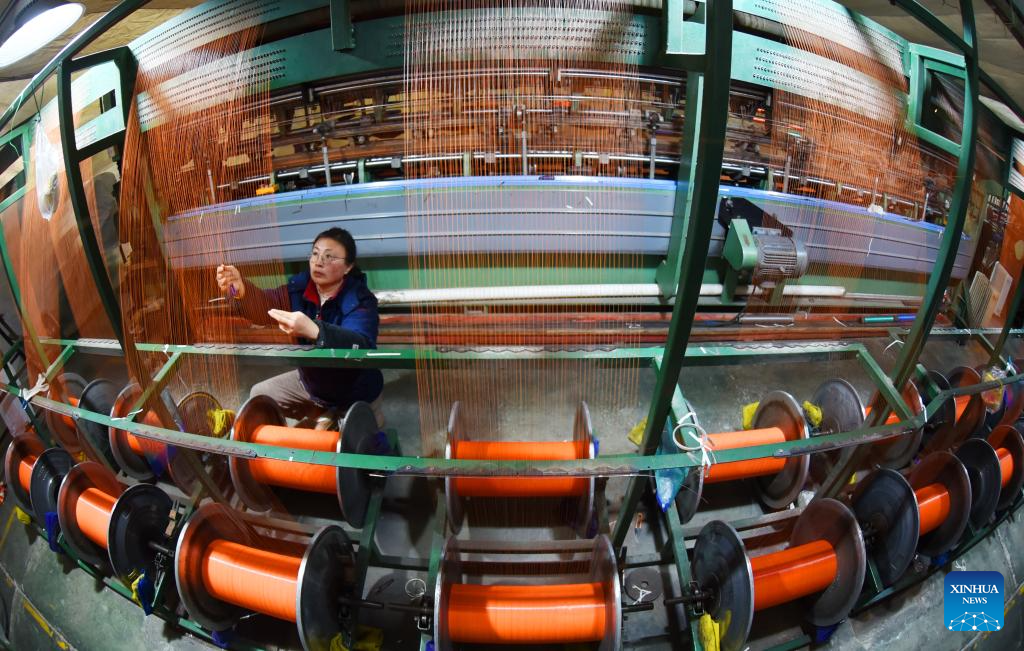

A worker is seen at a factory at the Haigang economic zone in Tangshan, north China's Hebei Province, Jan. 27, 2026. (Photo by Liu Mancang/Xinhua)

BEIJING, Jan. 27 (Xinhua) -- Profits of China's major industrial firms returned to growth in 2025, snapping a three-year streak of declines, with emerging sectors such as equipment manufacturing and high-tech manufacturing serving as major growth drivers.

Data from the National Bureau of Statistics (NBS) showed on Tuesday that profits for these firms increased 0.6 percent year on year to nearly 7.4 trillion yuan (about 1.06 trillion U.S. dollars) last year, accelerating from a 0.1-percent growth in the January-November period.

A substantial recovery was evident in December, with these firms posting a 5.3-percent year-on-year profit increase, a sharp turnaround from the 13.1-percent decline recorded in November.

Major industrial firms refer to those with an annual main business revenue of at least 20 million yuan.

"With the implementation of more proactive and effective macro policies last year, China sped up new industrialization and fostered steady improvement in industrial performance," said NBS statistician Yu Weining.

INNOVATION-DRIVEN, QUALITY-FOCUSED

As a global manufacturing leader for years, China is shifting its focus from scale-driven growth to innovation- and quality-oriented development. This pivot is aimed at boosting competitiveness and moving the country up the global value chain.

Tuesday's data indicated that this transition is taking hold.

In 2025, profits of the equipment manufacturing sector rose 7.7 percent year on year. This growth contributed 2.8 percentage points to the overall profit increase of major industrial enterprises, making it the largest contributor.

The sector's share of total industrial profits reached 39.8 percent, up 2.6 percentage points from the previous year, reflecting further optimization of the industrial profit structure.

High-tech manufacturing continued to show strong momentum, with profits rising 13.3 percent year on year and outpacing the growth rate of all major industrial firms by 12.7 percentage points. Intelligent electronics manufacturing continued to expand with profits in unmanned aerial vehicle manufacturing and intelligent in-vehicle equipment manufacturing surging by 102 percent and 88.8 percent, respectively.

Last year, profits at major small and medium-sized enterprises and overseas-invested firms rose 1.4 percent and 4.2 percent year on year, reversing their declines from 2024.

Looking ahead, efforts must be made to advance the deep integration of scientific and technological innovation with industrial innovation, accelerate the cultivation of new quality productive forces, and promote the sustained improvement of industrial enterprise performance, Yu noted.

REINING IN VICIOUS COMPETITION

The steady profit growth recorded last year was partly attributed to China's crackdown on "involution-style" competition -- a concept that has gained traction in recent years to describe cutthroat market dynamics, where companies aggressively slash prices to gain market share, often resulting in a self-defeating cycle of diminishing returns.

Analysts have warned that such unchecked, disorderly competition could create a race to the bottom, stifling innovation and hindering China's long-term economic development.

The issue garnered broad attention after a Chinese central leadership meeting in July 2024 urged stronger industry discipline and the prevention of "involution-style" competition.

Since then, China has rolled out a raft of targeted measures to address the issue, including capacity control in crowded sectors such as photovoltaic and cement, pricing monitoring for new energy vehicles, and the phase-out of obsolete industrial capacity.

The Central Economic Work Conference held in December last year listed the crackdown on "involution-style" competition as one of the key tasks for this year's economic work.

These policies have already started to yield results. The country's producer price index, a gauge of factory-gate prices, has registered month-on-month growth for three consecutive months since October 2025.

Producer prices in hard-hit sectors including photovoltaic equipment and component manufacturing, and lithium-ion battery manufacturing bottomed out and rebounded on a month-on-month basis starting in September.

China's anti-involution policies aim to tackle excessive market competition and restore corporate profitability, and their positive impacts will become increasingly evident throughout 2026, said Ding Shuang, chief economist of Greater China and North Asia with Standard Chartered. ■

A worker works on a wire harness production line at an electronics technology company in Suixian County of Shangqiu City, central China's Henan Province, Jan. 27, 2026. Profits of China's major industrial firms returned to growth in 2025, snapping a three-year streak of declines, with emerging sectors such as equipment manufacturing and high-tech manufacturing serving as major growth drivers.

Data from the National Bureau of Statistics (NBS) showed on Tuesday that profits for these firms increased 0.6 percent year on year to nearly 7.4 trillion yuan (about 1.06 trillion U.S. dollars) last year, accelerating from a 0.1-percent growth in the January-November period.

A substantial recovery was evident in December, with these firms posting a 5.3-percent year-on-year profit increase, a sharp turnaround from the 13.1-percent decline recorded in November.

Major industrial firms refer to those with an annual main business revenue of at least 20 million yuan. (Photo by Xu Zeyuan/Xinhua)

Intelligent equipment is pictured at a digital workshop of a cosmetics packing company in Huangjiabu Town of Yuyao City, east China's Zhejiang Province, Jan. 27, 2026. Profits of China's major industrial firms returned to growth in 2025, snapping a three-year streak of declines, with emerging sectors such as equipment manufacturing and high-tech manufacturing serving as major growth drivers.

Data from the National Bureau of Statistics (NBS) showed on Tuesday that profits for these firms increased 0.6 percent year on year to nearly 7.4 trillion yuan (about 1.06 trillion U.S. dollars) last year, accelerating from a 0.1-percent growth in the January-November period.

A substantial recovery was evident in December, with these firms posting a 5.3-percent year-on-year profit increase, a sharp turnaround from the 13.1-percent decline recorded in November.

Major industrial firms refer to those with an annual main business revenue of at least 20 million yuan. (Photo by Zhang Hui/Xinhua)

A drone photo taken on Jan. 27, 2026 shows workers piling products at a factory in Simao District, Pu'er City, southwest China's Yunnan Province. Profits of China's major industrial firms returned to growth in 2025, snapping a three-year streak of declines, with emerging sectors such as equipment manufacturing and high-tech manufacturing serving as major growth drivers.

Data from the National Bureau of Statistics (NBS) showed on Tuesday that profits for these firms increased 0.6 percent year on year to nearly 7.4 trillion yuan (about 1.06 trillion U.S. dollars) last year, accelerating from a 0.1-percent growth in the January-November period.

A substantial recovery was evident in December, with these firms posting a 5.3-percent year-on-year profit increase, a sharp turnaround from the 13.1-percent decline recorded in November.

Major industrial firms refer to those with an annual main business revenue of at least 20 million yuan. (Photo by Yang Tingrong/Xinhua)

A worker works on a production line at a motorcycle company in Tongren City, southwest China's Guizhou Province, Jan. 27, 2026. Profits of China's major industrial firms returned to growth in 2025, snapping a three-year streak of declines, with emerging sectors such as equipment manufacturing and high-tech manufacturing serving as major growth drivers.

Data from the National Bureau of Statistics (NBS) showed on Tuesday that profits for these firms increased 0.6 percent year on year to nearly 7.4 trillion yuan (about 1.06 trillion U.S. dollars) last year, accelerating from a 0.1-percent growth in the January-November period.

A substantial recovery was evident in December, with these firms posting a 5.3-percent year-on-year profit increase, a sharp turnaround from the 13.1-percent decline recorded in November.

Major industrial firms refer to those with an annual main business revenue of at least 20 million yuan. (Photo by Shen Yikai/Xinhua)

An aerial drone photo taken on Nov. 13, 2025 shows workers building a vessel at a factory of China COSCO Shipping Heavy Industry Co., Ltd in Yangzhou, east China's Jiangsu Province. Profits of China's major industrial firms returned to growth in 2025, snapping a three-year streak of declines, with emerging sectors such as equipment manufacturing and high-tech manufacturing serving as major growth drivers.

Data from the National Bureau of Statistics (NBS) showed on Tuesday that profits for these firms increased 0.6 percent year on year to nearly 7.4 trillion yuan (about 1.06 trillion U.S. dollars) last year, accelerating from a 0.1-percent growth in the January-November period.

A substantial recovery was evident in December, with these firms posting a 5.3-percent year-on-year profit increase, a sharp turnaround from the 13.1-percent decline recorded in November.

Major industrial firms refer to those with an annual main business revenue of at least 20 million yuan. (Photo by Ren Fei/Xinhua)

A worker is seen on an LED production line at an electronics company in Zigui County, central China's Hubei Province, Jan. 27, 2026. Profits of China's major industrial firms returned to growth in 2025, snapping a three-year streak of declines, with emerging sectors such as equipment manufacturing and high-tech manufacturing serving as major growth drivers.

Data from the National Bureau of Statistics (NBS) showed on Tuesday that profits for these firms increased 0.6 percent year on year to nearly 7.4 trillion yuan (about 1.06 trillion U.S. dollars) last year, accelerating from a 0.1-percent growth in the January-November period.

A substantial recovery was evident in December, with these firms posting a 5.3-percent year-on-year profit increase, a sharp turnaround from the 13.1-percent decline recorded in November.

Major industrial firms refer to those with an annual main business revenue of at least 20 million yuan. (Photo by Wang Gang/Xinhua)

A drone photo taken on Jan. 27, 2026 shows workers working at a workshop of an auto company in Gui'an New Area, southwest China's Guizhou Province. Profits of China's major industrial firms returned to growth in 2025, snapping a three-year streak of declines, with emerging sectors such as equipment manufacturing and high-tech manufacturing serving as major growth drivers.

Data from the National Bureau of Statistics (NBS) showed on Tuesday that profits for these firms increased 0.6 percent year on year to nearly 7.4 trillion yuan (about 1.06 trillion U.S. dollars) last year, accelerating from a 0.1-percent growth in the January-November period.

A substantial recovery was evident in December, with these firms posting a 5.3-percent year-on-year profit increase, a sharp turnaround from the 13.1-percent decline recorded in November.

Major industrial firms refer to those with an annual main business revenue of at least 20 million yuan. (Photo by Yuan Fuhong/Xinhua)

A full automation production line is pictured at a PV glass company in southwest China's Guizhou Province, Jan. 27, 2026. Profits of China's major industrial firms returned to growth in 2025, snapping a three-year streak of declines, with emerging sectors such as equipment manufacturing and high-tech manufacturing serving as major growth drivers.

Data from the National Bureau of Statistics (NBS) showed on Tuesday that profits for these firms increased 0.6 percent year on year to nearly 7.4 trillion yuan (about 1.06 trillion U.S. dollars) last year, accelerating from a 0.1-percent growth in the January-November period.

A substantial recovery was evident in December, with these firms posting a 5.3-percent year-on-year profit increase, a sharp turnaround from the 13.1-percent decline recorded in November.

Major industrial firms refer to those with an annual main business revenue of at least 20 million yuan. (Photo by Yu Tianying/Xinhua)

An aerial drone photo taken on Jan. 27, 2026 shows workers building a vessel at a ship building factory in Nanjing, east China's Jiangsu Province. Profits of China's major industrial firms returned to growth in 2025, snapping a three-year streak of declines, with emerging sectors such as equipment manufacturing and high-tech manufacturing serving as major growth drivers.

Data from the National Bureau of Statistics (NBS) showed on Tuesday that profits for these firms increased 0.6 percent year on year to nearly 7.4 trillion yuan (about 1.06 trillion U.S. dollars) last year, accelerating from a 0.1-percent growth in the January-November period.

A substantial recovery was evident in December, with these firms posting a 5.3-percent year-on-year profit increase, a sharp turnaround from the 13.1-percent decline recorded in November.

Major industrial firms refer to those with an annual main business revenue of at least 20 million yuan. (Photo by Shi Jun/Xinhua)

An aerial drone photo taken on Jan. 27, 2026 shows a vessel loading vehicles for export at Yantai Port in Yantai, east China's Shandong Province. Profits of China's major industrial firms returned to growth in 2025, snapping a three-year streak of declines, with emerging sectors such as equipment manufacturing and high-tech manufacturing serving as major growth drivers.

Data from the National Bureau of Statistics (NBS) showed on Tuesday that profits for these firms increased 0.6 percent year on year to nearly 7.4 trillion yuan (about 1.06 trillion U.S. dollars) last year, accelerating from a 0.1-percent growth in the January-November period.

A substantial recovery was evident in December, with these firms posting a 5.3-percent year-on-year profit increase, a sharp turnaround from the 13.1-percent decline recorded in November.

Major industrial firms refer to those with an annual main business revenue of at least 20 million yuan. (Photo by Zhang Chao/Xinhua)

A worker makes netting gears at a factory in Haizhou industrial park in Lianyungang, east China's Jiangsu Province, Jan. 27, 2026. Profits of China's major industrial firms returned to growth in 2025, snapping a three-year streak of declines, with emerging sectors such as equipment manufacturing and high-tech manufacturing serving as major growth drivers.

Data from the National Bureau of Statistics (NBS) showed on Tuesday that profits for these firms increased 0.6 percent year on year to nearly 7.4 trillion yuan (about 1.06 trillion U.S. dollars) last year, accelerating from a 0.1-percent growth in the January-November period.

A substantial recovery was evident in December, with these firms posting a 5.3-percent year-on-year profit increase, a sharp turnaround from the 13.1-percent decline recorded in November.

Major industrial firms refer to those with an annual main business revenue of at least 20 million yuan. (Photo by Geng Yuhe/Xinhua)

A worker is seen at a factory at the Haigang economic zone in Tangshan, north China's Hebei Province, Jan. 27, 2026. Profits of China's major industrial firms returned to growth in 2025, snapping a three-year streak of declines, with emerging sectors such as equipment manufacturing and high-tech manufacturing serving as major growth drivers.

Data from the National Bureau of Statistics (NBS) showed on Tuesday that profits for these firms increased 0.6 percent year on year to nearly 7.4 trillion yuan (about 1.06 trillion U.S. dollars) last year, accelerating from a 0.1-percent growth in the January-November period.

A substantial recovery was evident in December, with these firms posting a 5.3-percent year-on-year profit increase, a sharp turnaround from the 13.1-percent decline recorded in November.

Major industrial firms refer to those with an annual main business revenue of at least 20 million yuan. (Photo by Liu Mancang/Xinhua)

A worker lifts a roll of aluminum at a new material company in Qingyang Town, Zouping City of east China's Shandong Province, Jan. 20, 2026. Profits of China's major industrial firms returned to growth in 2025, snapping a three-year streak of declines, with emerging sectors such as equipment manufacturing and high-tech manufacturing serving as major growth drivers.

Data from the National Bureau of Statistics (NBS) showed on Tuesday that profits for these firms increased 0.6 percent year on year to nearly 7.4 trillion yuan (about 1.06 trillion U.S. dollars) last year, accelerating from a 0.1-percent growth in the January-November period.

A substantial recovery was evident in December, with these firms posting a 5.3-percent year-on-year profit increase, a sharp turnaround from the 13.1-percent decline recorded in November.

Major industrial firms refer to those with an annual main business revenue of at least 20 million yuan. (Photo by Dong Naide/Xinhua)

A drone photo taken on Jan. 27, 2026 shows vehicles to be loaded onto vessels at a dock in Lianyungang, east China's Jiangsu Province. Profits of China's major industrial firms returned to growth in 2025, snapping a three-year streak of declines, with emerging sectors such as equipment manufacturing and high-tech manufacturing serving as major growth drivers.

Data from the National Bureau of Statistics (NBS) showed on Tuesday that profits for these firms increased 0.6 percent year on year to nearly 7.4 trillion yuan (about 1.06 trillion U.S. dollars) last year, accelerating from a 0.1-percent growth in the January-November period.

A substantial recovery was evident in December, with these firms posting a 5.3-percent year-on-year profit increase, a sharp turnaround from the 13.1-percent decline recorded in November.

Major industrial firms refer to those with an annual main business revenue of at least 20 million yuan. (Photo by Wang Chun/Xinhua)

A drone photo taken on Jan. 22, 2026 shows vessels under construction at a ship building base in Rongcheng City, east China's Shandong Province. Profits of China's major industrial firms returned to growth in 2025, snapping a three-year streak of declines, with emerging sectors such as equipment manufacturing and high-tech manufacturing serving as major growth drivers.

Data from the National Bureau of Statistics (NBS) showed on Tuesday that profits for these firms increased 0.6 percent year on year to nearly 7.4 trillion yuan (about 1.06 trillion U.S. dollars) last year, accelerating from a 0.1-percent growth in the January-November period.

A substantial recovery was evident in December, with these firms posting a 5.3-percent year-on-year profit increase, a sharp turnaround from the 13.1-percent decline recorded in November.

Major industrial firms refer to those with an annual main business revenue of at least 20 million yuan. (Photo by Wang Fudong/Xinhua)

A drone photo taken on Jan. 27, 2026 shows a floating production storage and offloading (FPSO) vessel at a construction base of CIMC Raffles in Yantai, east China's Shandong Province. Profits of China's major industrial firms returned to growth in 2025, snapping a three-year streak of declines, with emerging sectors such as equipment manufacturing and high-tech manufacturing serving as major growth drivers.

Data from the National Bureau of Statistics (NBS) showed on Tuesday that profits for these firms increased 0.6 percent year on year to nearly 7.4 trillion yuan (about 1.06 trillion U.S. dollars) last year, accelerating from a 0.1-percent growth in the January-November period.

A substantial recovery was evident in December, with these firms posting a 5.3-percent year-on-year profit increase, a sharp turnaround from the 13.1-percent decline recorded in November.

Major industrial firms refer to those with an annual main business revenue of at least 20 million yuan. (Photo by Tang Ke/Xinhua)