Vehicle carrier vessel "BYD EXPLORER NO.1" arrives at Xiaomo International Logistics Port in Shenzhen, south China's Guangdong Province, Jan. 14, 2024. "BYD EXPLORER NO.1," leased to Chinese automaker BYD, held its maiden voyage ceremony at the port. (Xinhua)

"The whole hype about Chinese subsidies to battery EVs is simply unnecessary and a detraction from the EU's real problems," said Shi Yonghong, vice president of CCCME.

BRUSSELS, April 13 (Xinhua) -- A Chinese industry body on Friday criticized the European Union (EU) for double standards and a lack of fairness and transparency in the European Commission's investigation into imported Chinese electric vehicles (EVs).

The China Chamber of Commerce for Import and Export of Machinery and Electronic Products (CCCME) represents 12 Chinese EV exporting producers, including three sampled producers that are being individually investigated by the Commission.

Shi Yonghong, vice president of CCCME, stressed at a press conference held in Brussels that the organization and Chinese EV companies have consistently reported procedural issues and a lack of access to basic information in the case. Despite these submissions, they have received no response from the Commission, nor observed any efforts by the Commission to address their concerns.

Chinese company Xiaomi's SU7 car is displayed during the Mobile World Congress (MWC) in Barcelona, Spain, Feb. 27, 2024. (Xinhua/Gao Jing)

DOUBLE STANDARDS FROM EU

The European Commission initiated an anti-subsidy investigation into EV imports from China last October and is set to determine whether punitive tariffs should be imposed to protect EU manufacturers from Chinese competitors.

Shi described the investigation as "a perfect example of the EU's double standards," noting the intentional selection of three Chinese EV producers --BYD, Geely, and SAIC-- for the anti-subsidy probe.

According to Shi, the Commission's practice has violated established legal protocols and contradicts previous practices of evaluating exporters with the highest volume of exports to the EU. He stressed that the biased sample selection has "tainted the entire investigation process."

Data from the clean transport campaign group Transport and Environment showed that Tesla and Renault's Dacia were the top two exporters from China to the EU. However, these two were not included in the samples for the probe.

Edwin Vermulst, partner at Brussels-based international law firm VVGB, commented on the unusual exclusion of the largest exporters in sampling and the introduction of new criteria to selectively target the three Chinese producers, saying that such practices are uncommon and deviate from established precedents and World Trade Organization (WTO) norms.

Shi also criticized the EU for its inaction regarding the U.S. allocation of nearly 400 billion dollars in subsidies under the country's Inflation Reduction Act, as well as the billions of euros in subsidies that the EU itself is providing to its own battery and EV production.

"The whole hype about Chinese subsidies to battery EVs is simply unnecessary and a detraction from the EU's real problems," Shi stressed.

This photo taken on Feb. 1, 2024 shows a Chinese electric car MG4 on display at an MG sales center in Ljubljana, Slovenia. (Xinhua/Zhou Yue)

CALL FOR FAIRNESS, TRANSPARENCY

Highlighting transparency issues, Shi noted that EU producers have been granted anonymity, and the Commission has failed to meet its WTO obligations to provide basic information about the data and data sources used for assessing industry injury.

Juhi Dion Sud, another partner at VVGB, pointed out that the case was initiated by the Commission itself, which is uncommon, and not by any complaint from the industry.

BMW's Chief Financial Officer Walter Mertl suggested that the investigation may disproportionately affect carmakers with minimal sales in China while impacting the entire automotive industry engaged in business with China, doing more harm than good.

In addition to transparency and procedural issues, Shi also highlighted that the Commission required 200 affiliates of the three sampled Chinese exporting producers to submit questionnaire responses, and these companies were subjected to higher, tougher, and more exacting standards compared to their EU counterparts in the EV industry.

Vermulst expressed surprise and concern over the Commission's demand for extensive information from numerous companies within a short timeframe, noting that such a request was unprecedented in his extensive career.

"The findings are very likely to be distorted and unobjective," Shi said, urging the EU to adopt a more objective, fair, and transparent approach in its ongoing probe and to refrain from adopting any protectionist measures.

At a hearing with the European Commission on Thursday, the CCCME and participating Chinese firms reiterated their concerns but received no feedback. Zhou Qi, chief legal counsel for the Shanghai-headquartered SAIC Motor, expressed frustration over the lack of engagement from the EU body.

"We are not afraid of competition, but we fear being treated unfairly," Zhou noted.

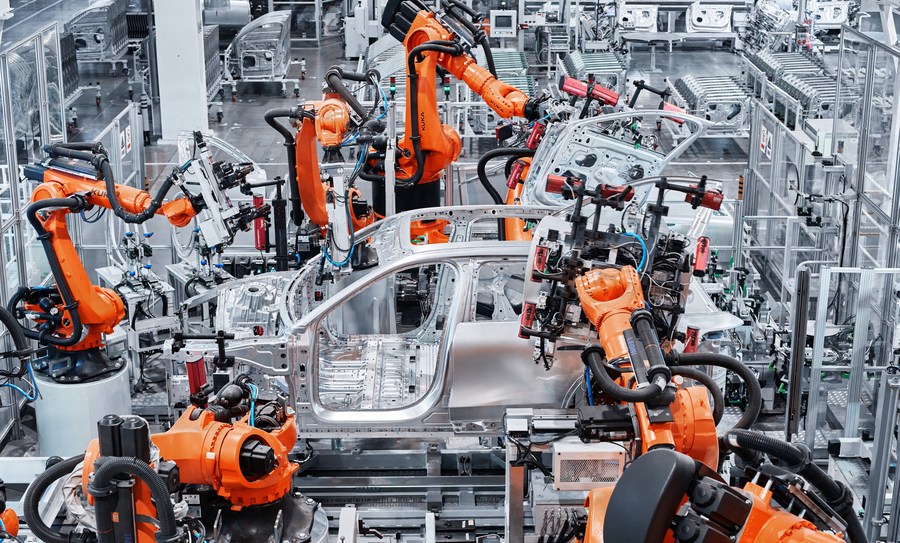

This photo taken on Oct. 10, 2023 shows Chinese premium electric car company NIO's Second Advanced Manufacturing Base in Hefei, east China's Anhui Province, which adopts cutting-edge technologies such as intelligent manufacturing management system, the "Magic Cube" vehicle access platform, and automated assembly island. (Xinhua)

CHINESE EV FLOODING EU MARKET?

Addressing claims that Chinese EVs are usurping EU market share due to government subsidies, Shi presented evidence suggesting otherwise.

He referenced European economists who noted that Chinese and EU brands generally occupy distinct market segments and that the main importers of Chinese EVs are the EU producers themselves.

Additionally, Shi mentioned that Chinese EV producers made a head start in EV production due to strong domestic competition, technological advancement, economies of scale, robust supply chains and comparative advantages driven by market forces.

"These are the real reasons behind the rapid growth of Chinese EVs, rather than the alleged government subsidies, as the Commission seems to be convinced about," Shi said.

Chinese vehicles are "simply good cars and people buy them," Mathias Miedreich, CEO of Umicore headquartered in Belgium, was quoted by the London-based Financial Times as saying.

Chinese Minister of Commerce Wang Wentao also said Sunday that Chinese EV manufacturers' rapid development is a result of constant tech innovations, a well-established supply chain system and full market competition, not subsidies. ■