* The Chinese economy recorded a general upward trajectory in the first half of this year.

* With its super-sized market and great domestic demand potential, China possesses strong economic resilience and abundant room for maneuvering.

* Since the beginning of this year, multiple visits to China by executives of multinationals, including Tesla, J.P. Morgan Chase, and Apple, have already cast a vote of confidence in China's economic outlook.

BEIJING, July 21 (Xinhua) -- The Chinese economy recorded a general upward trajectory in the first half of this year, with fluctuations also being spotted. As optimism and pessimism both arose, how does one correctly judge the economic trend?

The following analysis in six aspects, from demand to employment, offers a glimpse into the performance and prospects of the world's second-largest economy.

ECONOMIC RECOVERY

With a rosy start and a stable second quarter, the macro economy experienced an unusual recovery curve.

Above all, China's growth is praiseworthy against a slowing global economy backdrop. In the first six months, China secured a 5.5-percent GDP expansion -- quicker than 2022 and this year's first quarter -- driven by stronger consumption and steadily improving services.

Secondly, economic vibrancy did soften in the April-June period, with weakening indicators from exports to industrial profits. However, it is normal to see some volatility during the post-COVID-19 recovery phases, said Liu Yuanchun, president of the Shanghai University of Finance and Economics.

Besides, despite headwinds at home and abroad this year, China's economic growth had higher quality, with continued transformation and upgrades.

This aerial photo taken on July 5, 2023 shows cars to be loaded for export at Yantai Port in east China's Shandong Province. (Photo by Tang Ke/Xinhua)

For instance, China's 20 millionth new energy vehicle rolled off the production line early this month in the southern Chinese city of Guangzhou, marking a milestone for the country's green drive. China's exports of solar batteries, lithium-ion batteries, and electric vehicles soared amid sluggish global trade. The equipment manufacturing and high-tech industries also registered robust growth.

Chinese authorities have recognized the difficulties and pledged more efforts to bolster the economy. Pressures and challenges will not change the sound long-term economic trend, said Meng Wei, spokesperson for the National Development and Reform Commission.

DOMESTIC DEMAND

Gauged by short-term indicators, the recovery of China's domestic demand in recent months slowed down from the first quarter as insufficient market demand and tepid endogenous impetus remained a drag on growth.

But packed subway trains, long queues at restaurants, and humming machines in factories across the country are adding strength to an economic upturn.

Liu Guoqiang, deputy governor of the People's Bank of China, stressed that it takes time for consumption to return to normal.

It has only been about half a year since China adjusted its COVID-19 response, and positive signs have emerged already in areas including economic circulation, residents' incomes, and consumption, Liu said.

Staff members work at the construction site of Zangke River grand bridge on the expressway linking Nayong and Qinglong in southwest China's Guizhou Province, June 25, 2023. (Xinhua/Tao Liang)

In the first half, infrastructure and high-tech investment maintained robust increases, and private investment, excluding those in property development, saw a 9.4-percent rapid expansion from a year ago.

Further expanding domestic demand remains key to sustaining recovery. To that end, China has rolled out various measures to boost consumer spending on new-energy vehicles, household items, and other areas and encourage private capital to partake in the major national projects as outlined in the 14th Five-Year Plan (2021-2025).

With its super-sized market and great domestic demand potential, China possesses strong economic resilience and abundant room for maneuvering. What the country needs in the course of recovery is firm confidence and patience.

"Consumer spending will play a bigger role in shoring growth as supportive policies take further effect. Investment in infrastructure and manufacturing are resilient and will also help expand domestic demand," said Fu Linghui, a National Bureau of Statistics spokesperson.

UNEMPLOYMENT

China's job market has been stable this year, with the unemployment rate of those between 25 and 59 years old in June at 4.1 percent, lower than the pre-pandemic level in 2019. However, a 21.3 percent surveyed unemployment rate among urban youths aged between 16 and 24 revealed prominent structural problems and the arduous task of helping job seekers in need.

In response, Chinese authorities have taken a multi-pronged approach to tackle the challenge.

This photo taken on April 21, 2023 shows a job fair held in Yinchuan, northwest China's Ningxia Hui Autonomous Region. (Xinhua/Feng Kaihua)

The Ministry of Human Resources and Social Security plans to create 1 million intern jobs this year and organize vocational skills training for more than 15 million people. Local governments have rolled out differentiated favorable policies for key job-seeking groups, including fresh college graduates.

Recently, a semiconductor material company in Hohhot, north China's Inner Mongolia Autonomous Region, received a refund of 165,000 yuan (about 23,091 U.S. dollars) under a government program that grants employers with no or few layoffs refunds of unemployment-insurance premiums.

"There's even no need to file an application. The money is transferred directly to our account. It's a great encouragement for us to stabilize employment and continue to develop," the company's general manager Wang Yanjun said.

Addressing the unemployment problem, in essence, still lies in development, analysts said, pinning high hopes on China's upgraded traditional industries and fast-growing emerging sectors to drive job creation.

In the next stage, the sustained economic recovery, growing labor demand, and government policies will jointly guarantee employment stability, Fu Linghui said.

DEFLATION OR INFLATION

While the economy has been on track for a steady recovery, low-running domestic prices have raised market concerns over deflation.

The mild rise in the consumer price index -- a 0.7-percent year-on-year increase in the first half -- was attributable to a time lag in demand recovery and a high base last year when food and energy prices spiked due to the Ukraine crisis. The producer price index (PPI) dropped 3.1 percent due to falling global commodity prices and inadequate domestic market demand.

However, from a rational perspective, relatively low inflation allows more room for macro policies to spur growth. The current low price level is temporary, and its impacts should not be exaggerated.

Wang Likun, a researcher with the Development Research Center of the State Council, predicted a moderate PPI rebound in the second half as demand for industrial goods would gradually increase, and the base effect would diminish.

The government is also on the move to deliver more supportive measures. In June, the country's loan prime rate, a market-based benchmark lending rate, was lowered, sending policy signals of strengthening counter-cyclical adjustments and anchoring market expectations.

There is no basis for long-term deflation or inflation in China, Zou Lan, an official with the People's Bank of China, said. "The economy's supply and demand has been basically balanced, with reasonable and moderate monetary conditions, and stable expectations among residents."

BUSINESS EXPECTATIONS

China's business confidence has largely improved this year. But the sentiment still diverged in different sectors as lingering epidemic impacts and external changes exacerbated the difficulties facing micro, small, and medium-sized enterprises.

Tourists visit a night market in Liuzhou, south China's Guangxi Zhuang Autonomous Region, April 29, 2023. (Photo by Li Hanchi/Xinhua)

Analysts said building the confidence of various business entities, including private enterprises, is crucial to promoting a sustained economic recovery.

China has carried out a raft of measures to reassure entrepreneurs, including removing more barriers in market access, further reducing taxes and fees to save 1.8 trillion yuan for businesses this year, and boosting financial support for agriculture and rural areas as well as micro, small and private firms.

Recently, authorities issued a guideline to improve the growth of the private economy, promising to improve the business environment, enhance policy support, and strengthen the legal guarantee for its development.

The market confidence is expected to be further enhanced, Liu Xiangdong, a researcher with the China Center for International Economic Exchanges (CCIEE) said, citing effective policies to promote economic recovery, continuous improvements to a market-oriented, law-based, and internationalized business environment, and targeted relief measures to tackle businesses' difficulties.

Since the beginning of this year, multiple visits to China by executives of multinationals, including Tesla, J.P. Morgan Chase, and Apple, have already cast a vote of confidence in China's economic outlook.

As the Chinese economy has kept its recovery momentum this year with increasing production and unleashed pent-up demand, businesses can seize the opportunity to bolster strength and gear up for future development, analysts said.

DEFUSING RISKS

For the world's second-largest economy, lurking risks and hidden dangers in the property sector, local government debts, and some smaller financial institutions are among the challenges adding uncertainties to its recovery.

Despite being largely stable, China's real estate market has faced multiple challenges, with a dawdling recovery and dented confidence of developers and home buyers.

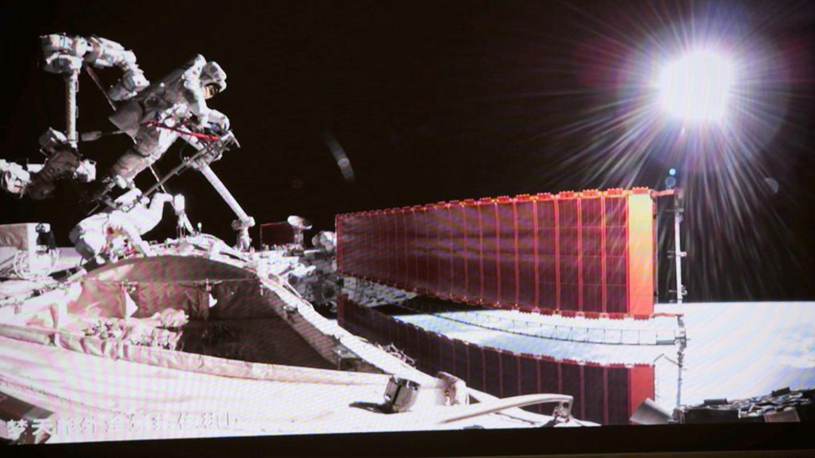

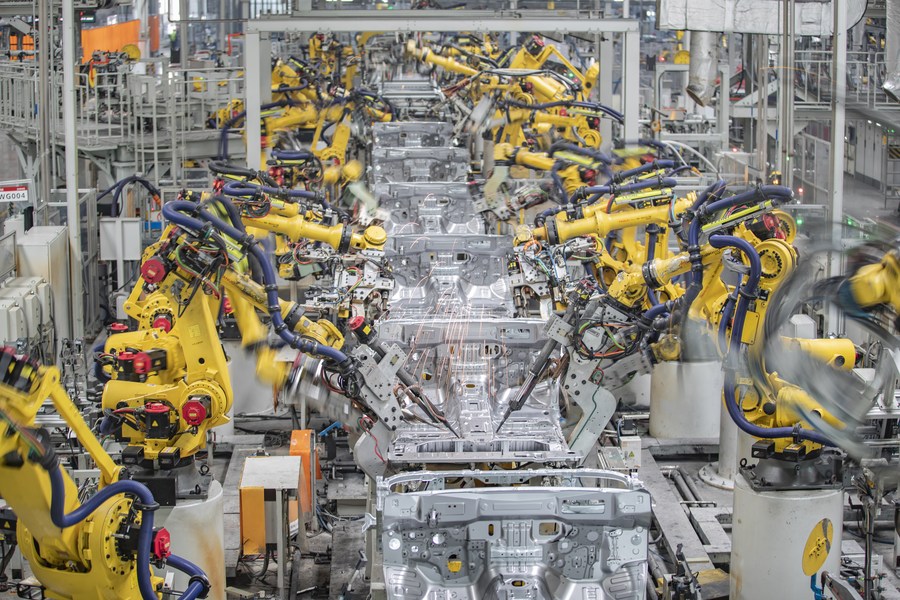

This photo taken on March 1, 2023 shows an intelligent production base of the Great Wall Motors (GWM) in Yongchuan District of Chongqing, southwest China. (Xinhua/Huang Wei)

Targeted policy measures were rolled out to meet the challenge. China's financial authorities have announced the extension of credit support to ensure the delivery of pre-sold homes. Over 100 cities have taken city-specific measures such as lower lending rates and looser restrictions to spur house purchasing.

"There is no systemic risk in the real estate sector, but the existence of supply-demand imbalance entails structural reforms in the long run," said Zhu Min, vice chairman of the CCIEE.

The country has done a lot to prevent and defuse risks in small and medium-sized financial institutions, which face increased operating pressure and concentrating regional risks.

By promoting restructuring and market exits, the Chinese financial regulator has managed to help some small lenders revive and significantly reduce the number of high-risk institutions. More will be done to advance mergers and acquisitions of smaller banks, improve the corporate governance of financial institutions, and give full play to the fund for ensuring financial stability.

The issue of local government debts also came under the spotlight recently.

While most of the provincial regions reported positive growth in fiscal revenue in the first quarter, local governments will likely retain a tight balance in their budgets due to lingering epidemic impacts and rising spending in key areas.

In response, China is weaving a stronger safety net against debt risks, with measures to tighten oversight, strictly implement lifelong accountability, and strengthen regulation over local government financing vehicles.

Generally speaking, the fiscal condition in China is safe and healthy, leaving ample leeway for dealing with risks and challenges, the Ministry of Finance has said, pledging to ensure the bottom line of no systemic risk.

(Video reporters: Li Yan, Lu Haiyue, Sun Qing, You Zhixin; video editors: Zheng Xin, Wei Yin, Liu Xiaorui) ■