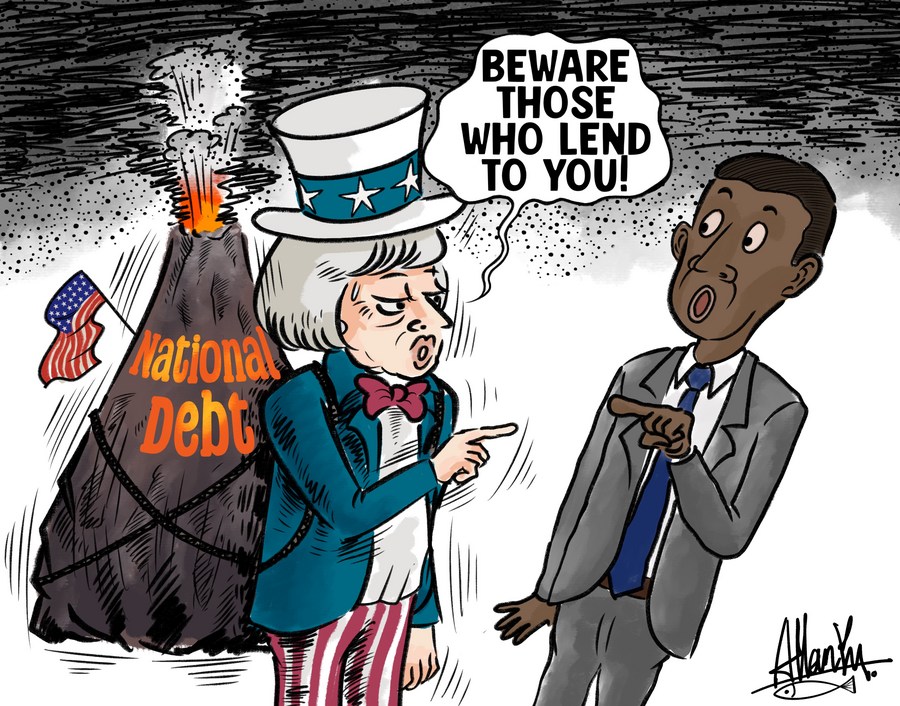

Cartoon: Guess who has debt issue?

"Western leaders blame China for debt crises in Africa, but this is a distraction. The truth is their own banks, asset managers and oil traders are far more responsible, but the G7 (the Group of Seven) are letting them off the hook," said Tim Jones, head of policy at the British NGO Debt Justice.

by Xinhua writers Liu Youmin, Yang Jun

BEIJING, Feb. 7 (Xinhua) -- Like many senior U.S. officials who have visited Africa, U.S. Treasury Secretary Janet Yellen did not fail to target China and raise concerns about China's role in the debt problem during a recent visit to the continent.

While hyping up the bizarre "Chinese debt trap," the U.S. officials deliberately ignored some key facts about African debt.

This photo taken on Jan. 20, 2023 shows the U.S. Department of the Treasury in Washington, D.C., the United States. (Xinhua/Liu Jie)

WHO HOLDS MOST AFRICAN DEBT?

According to the World Bank's International Debt Statistics, multilateral financial institutions and commercial creditors hold nearly three-quarters of Africa's total external debt.

A report published last July by the British NGO Debt Justice showed that 12 percent of the external debt of African countries is owed to Chinese lenders, compared to 35 percent to Western private lenders. The average interest rate of these private loans is 5 percent, compared with 2.7 percent for loans from Chinese public and private lenders.

"Western leaders blame China for debt crises in Africa, but this is a distraction. The truth is their own banks, asset managers and oil traders are far more responsible, but the G7 (the Group of Seven) are letting them off the hook," said Tim Jones, head of policy at Debt Justice.

In Chad, for example, the Swiss multinational commodity trading and mining company Glencore possesses about one-third of the country's external debt, while for Zambia, the American multinational investment company BlackRock is a major creditor, reported the French daily newspaper Le Monde on Jan. 30.

While calling for immediately addressing Zambia's heavy debt burden with China, Yellen deliberately ignored the fact that multilateral financial institutions and commercial creditors hold most of the country's external debt.

According to figures released by Zambia's Ministry of Finance and Planning, multilateral financial institutions account for 24 percent of the country's foreign debt, while predominantly Western commercial lenders account for 46 percent.

"Western lenders for long have not been put on the spotlight for debt relief because they successfully managed to dupe the world that it's only Chinese lenders that pose a threat to Africa," Uganda-based Vision Group journalist Mubarak Mugabo said.

Photo taken on Feb. 15, 2022 shows the exterior of the Kenneth Kaunda International Conference Center in Lusaka, Zambia. (Photo by Martin Mbangweta/Xinhua)

WHO IS RESPONSIBLE FOR THE DEBT CRISIS?

The causes of the debt crisis are multifaceted: the COVID-19 pandemic, geopolitical conflicts, a decline in global economic growth and economic structure vulnerabilities, among many other things, could all exacerbate the debt situation of some African countries.

Persistent inflation, prolonged tightening of global financial conditions, the high cost of capital, domestic currency depreciations and lower financial inflows could increase the risks of debt distress in some African countries, according to Africa's Macroeconomic Performance and Outlook published in January 2023 by the African Development Bank (AfDB).

In particular, the U.S. Federal Reserve's rate hikes and the strengthening of the U.S. dollar have greatly added to the debt service burden of African countries, the AfDB pointed out. For example, Ghana's currency, the cedi, depreciated more than 33.4 percent against the U.S. dollar in 2022.

Since most of the debt that emerging and low-income countries should be paid in a foreign currency, notably the U.S. dollar and Euro, irresponsible U.S.-government policies have added fuel to the fire.

In contrast, China has been an ardent supporter of the Group of 20 Debt Service Suspension Initiative. The country has signed agreements or reached consensus with 19 African countries on debt relief and has suspended the most debt service payments of any G20 member. China has also actively addressed the debt of Chad, Ethiopia and Zambia on a case-by-case basis within the G20 framework.

"They depict China as a predatory lender that is weaponizing capital in order to practice a new form of colonialism in Africa. However, such accusations have little factual basis," noted Costantinos Bt. Costantinos, professor of public policy at the Addis Ababa University in Ethiopia.

"The debt trap issue has been a political smear," said Charles Onunaiju, director of the Nigeria-based Center for China Studies, adding that such claims are just a red herring to absolve the West of any responsibility.

Vehicles drive on an expressway between the Jomo Kenyatta International Airport and Nairobi's central business district, in Kenya, May 14, 2022. (Xinhua/Long Lei)

WHO CONTRIBUTES MORE TO AFRICAN DEVELOPMENT?

During trips to Africa, American officials may not have realized that when they disembarked from a plane, they were likely headed toward a terminal built by a Chinese company. And their cars were also driving on roads or bridges built by a Chinese contractor. Modern infrastructure built by China is ubiquitous across Africa.

The increase in debt stock could also be a positive sign, and not just a pathology, according to an article published in June last year on the website of The Africa Report. Many sub-Saharan African economies experienced record growth before the pandemic. When gross domestic product increases, it is normal for debt to follow.

Suppose external debt contributes to a country's economic and social development in the long term and can be adequately managed. In that case, it could be called good debt, or in other words, financial aid for development.

Therefore, debt growth is only a trivial aspect of the problem. The rub is how to help African countries achieve sustainable, independent and high-quality development resulting in a balance of development financing and debt growth.

"China's financial assistance to Africa is largely aimed at realizing socio-economic and cultural projects of great importance, such as road infrastructure, hospitals, schools, bridges, etc.," Amadou Diop, a Senegalese expert on China, told Xinhua.

Statistics showed that since the Forum on China-Africa Cooperation was founded almost 23 years ago, Chinese companies have built or upgraded more than 10,000 km of railways, nearly 100,000 km of roads, roughly 1,000 bridges and 100 ports, and several hospitals and schools in Africa, creating more than 4.5 million jobs.

Published last July by a fellow in South Africa's University of Fort Hare, a quantitative study of the impact of China's loans on growth in 15 African countries concluded that China's efforts in developing infrastructure translate into economic growth.

According to the study, China has been and continues to be a significant force in assisting African countries in financing their development.

A survey issued last year by the Inter Region Economic Network, a Kenya-based think tank, found that China takes a substantial lead in decision-making and timely completion of infrastructure projects such as roads, power dams, railways and bridges in Africa. Facts and figures in the study showed that through efficient action, China tangibly contributes to Africa's development.

"There is a common feeling among African countries," said Ezzat Saad, director of the Egyptian Council for Foreign Affairs, "that China is a reliable partner, and there is a great trust and credibility in China-Africa cooperation." ■